WELCOME TO FUM TREND ANALYTICS!

Leverage the Power of Artificial Intelligence to turbo charge your investing decisions

FUM is an Artificial Intelligence System that Uses Quantitative Analysis To detect Asset Price Trends in Real-Time And Provide Actionable Investing Insights.

ADvanced Market trend analytics

Meet the system with the AI edge

Investors have long sought the advantage of AI for enhanced investment decision making. FUM delivers on this promise, enabling the ability to leverage the prevailing trend as it happens. By reacting to changing market conditions in real-time, investors stay on the right side of the trend, capturing profits during market rallies and preserving capital by avoiding corrections.

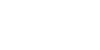

The above table shows the FUM Model account holdings, dated 2021-03-05. On that day, there were 5 profitable open positions ranging from just under 1% to 75%, with 3 positions showing double digit gains!

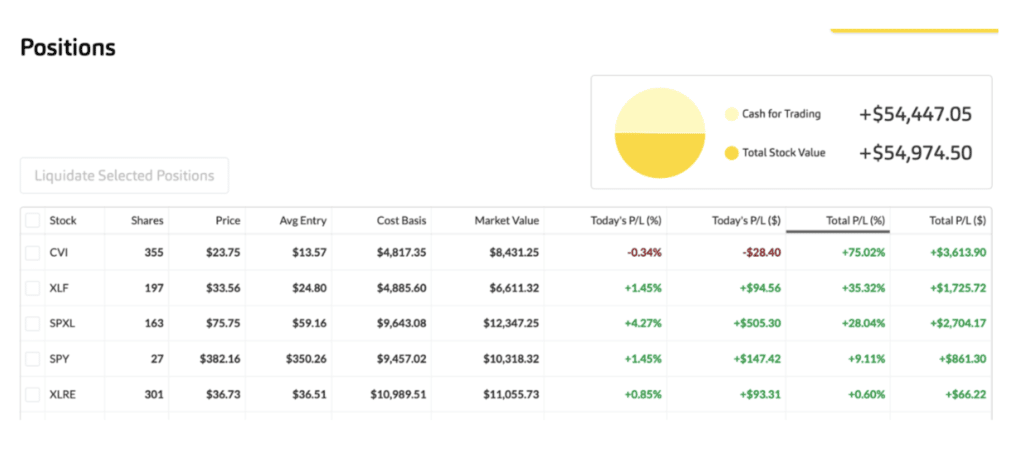

The above illustration shows the FUM Up trend signal as a green arrow and the end of the trend as the red arrow superimposed on a stock chart for XLE, the Sector Spyders Energy ETF. This trend captured a 6% gain in one month and provided advance alert to a 15% decline following the asset price top in June 2022.

Each day, FUM gathers and analyzes prices action data on 25+ cryptos and 800+ stocks, and ETFs. The AI performs a rule-based analysis of the data much like a chart reader, or chartist, to determine the current trend. The trend data is presented in an easy-to-read signal format.

FUM Trend Analytics Top benefits

Continuous Innovation

We take a value approach to the FUM service and apply cloud-native software development methods. FUM is a software AI math model that is routinely reviewed for trend accuracy improvement opportunities. Visualizations of the analytic asset trend information produced by the AI have been introduced. Additionally, stock valuation and economic models are also under consideration, adding further power to the FUM timing model.

Consistent Results

Trend analysis is based on the study of thousands of chart readings and the study of methods used by masters in the field. Trend analysis works because markets continually go up and down. These patterns repeat time and again, allowing subscribers to reap the benefits of remaining on the right side of the trend, catching up on trends early, and seeing down trends in advance.

Growth, Without Volatility

Investors who favor a growth strategy accept that wild swings are just part of the game. With FUM, growth is achieved with a huge reduction in volatility. This is a direct result of the benefit of trending. Since funds can be put to work during up trends and preserved during downtrends, capital grows without the crazy ups and downs.

Confident Decisions

Bringing it all together, you save time and feel good knowing the choices make will be based on data and logic, not emotion. Because patterns repeat themselves, confidence increases because we’ve seen them before. We know what to expect and what not to expect. It becomes routine and second nature.

FUM Trend Analytics Information Service

Subscription Options

AI Analytic Trend Signals

Designed to enable individuals to add trend analysis to their research and make data driven investing decisions. Offered as a monthly subscription, FUM AI analytic signals are provided by daily digital and email newsletter, with online chart visualizations. Capitalize in both rising and falling markets, adapting to volatile market conditions, with greater precision and with less risk.

• Stocks – US Broad Market Conditions, Industry Sector Flows, and Trend Signals for 700+ Stocks/ETFs, MSCI ETFs World Markets Summary, Volatility and Inverse ETFs, Currency Precious Metal ETFs, Asia ETFs, and Popular Chinese Stocks. Click here to see a complete list of tickers!

• Cryptocurrencies – Digital Currency Broad Market Conditions, Trend Signals for 25+ popular cryptos, Sentiment Readings.

The Magic of Technical Analysis

Crypto Coast Podcast

Check out our Spotify Crypto Coast podcast, with Jay from Crypto Concierge, on. We talk about the early days of the internet and explore how the AI model uses the magic of technical analysis. Of course, we have fun in the process.

TESTIMONIALS

Listen To Some Of Our Subscribers